To maximize your tax savings, you must have a good understanding of schemes that can help you bring down your taxable income. The Section 80C deduction is a crucial clause providing significant tax advantages to Indian taxpayers. In this post, we will go into the specifics of tax-saving instruments that fall under Section 80C of the Indian Income Tax Act 1961.

This will help you understand which ones are ideal for you and how you can use them to lower your taxable income.

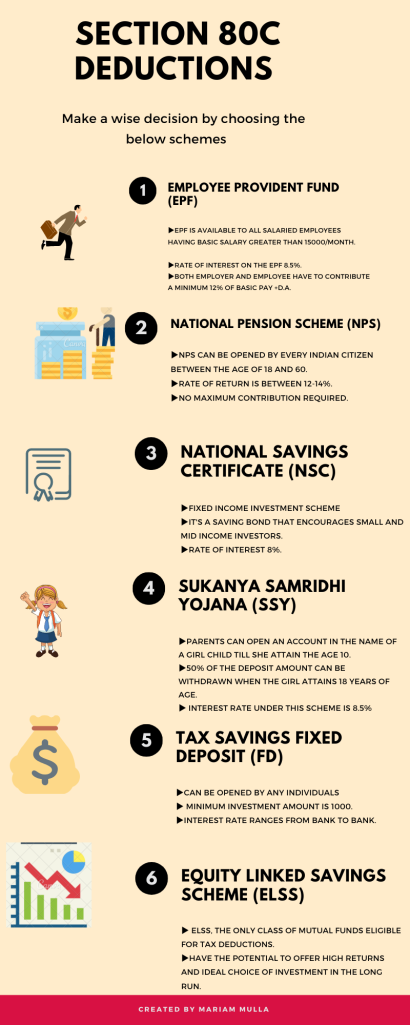

There are various investment schemes under Section 80C deductions that all bring down your taxable income. Let us understand these tax saving schemes:

- EPF: Contributions made to the Employee Provident Fund are deductible under section 80C of the tax code. If you are a salaried worker, a portion of your pay is contributed to your EPF account and is, therefore, deductible.

- PPF: You can minimize your taxable income by contributing towards the Public Provident Fund. PPF provides a pre-determined interest rate in addition to tax advantages.

- Life Insurance: Premiums for life insurance are deductible under section 80C of the tax code, including those for endowment and term policies. The premium must be at most 10% of the amount assured to be considered for the discount.

- Equity-Linked Savings Scheme (ELSS): ELSS is a mutual fund that invests in the equity market. It comes with a predetermined lock-in period of 3 years. Investments in ELSS are eligible for the 80C deduction, making them a popular option for taxpayers looking for both tax advantages and the possibility of long-term capital appreciation.

- National Savings Certificates (NSC): The Indian government offers NSCs as a fixed-income savings product. NSC investments qualify for the 80C deduction, making them a secure and dependable choice for tax-saving measures.

- Policies and Limitations: Although the 80C deduction provides alluring tax advantages, it is crucial to comprehend the policies and restrictions attached to it. Here are some essential ideas to bear in mind:

There is a lock-in period for some investments, including PPF and ELSS. This means you can only withdraw the money after a certain time. To properly organise your finances, be aware of the lock-in periods related to your investments.

1. Maximum Deduction:

Section 80C deduction can go up to Rs. 1.5 lakh. You can select a combination of qualifying investments and expenses to maximise your tax savings. Although you cannot avail of tax benefits for any amount exceeding Rs 1.5 lakhs, you can invest further to achieve your investment goals.

2. Financial Objectives vs Tax-Saving Investments:

Tax-saving investments are crucial, but matching them with your overall financial objectives is just as crucial. When choosing the best investment options under 80C, consider risk tolerance, investment horizon, and expected returns.

3. Tax planning:

It’s best to plan your investments at the start of the fiscal year to maximize 80C deductions. As a result, you can stretch out your investments throughout the year and base your decisions on your income and financial objectives.

Proper tax preparation requires an understanding of 80C deductions and their rules. You can drastically lower your taxable income and increase your savings by judiciously using the available options. To maximize your tax savings under Section 80C, evaluate your financial objectives, assess the appropriate investments and expenditures, and make wise judgments.

Always consult a financial advisor or a tax specialist to understand. Utilize the advantages provided by 80C deductions to optimize your tax liability while securing your financial future.

- Your Employees Matter, And It’s Time You Understood That - July 18, 2024

- Unlocking Insights: A Guide To Email Address Lookup - June 3, 2024

- A Comprehensive Guide To Maximising Your Tax Savings Through Section 80C Deductions - May 28, 2024

No Comments